What are “income-based costs” and how are they calculated?

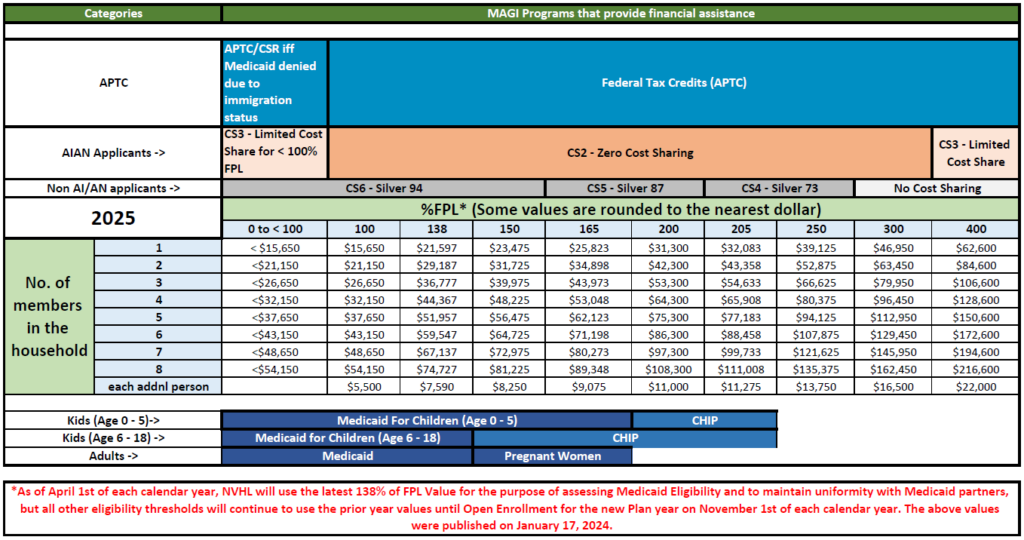

How much you pay each month for health insurance can be based on your annual household income. The chart below provides guidelines to the poverty threshold and shows different income levels relative to household size and a measurement called the Federal Poverty Level (FPL). The income below is only showing FPL levels from 138% to 400%. This is the range that consumers are eligible to receive financial subsidies through Nevada Health Link.

Use our anonymous saving calculator to see how much you could save.

Nevada Health Link is the only place where you could be eligible to receive financial assistance to help pay your monthly premium.

When applying for health insurance, you’ll find out if you qualify for premium tax credits and extra savings. These are called financial subsidies. There are two different federal subsidies:

Cost Sharing Reductions (CSRs)

CSRs are a discount or financial assistance which comes from the federal government for individuals in the 138-400% Federal Poverty Level (FPL). They lower the amount you have to pay for deductibles, copayments, and coinsurance. If you qualify for CSRs, you must enroll in a plan in the Silver category to get the extra savings.

Advanced Premium Tax Credit (APTC)

APTCs reduce the cost of your monthly premium. The federal tax credit goes directly to the insurance company, allowing you to pay less on your monthly bills right from the start.

Do I Qualify for Financial Assistance?

How much you pay each month for health insurance can be based on your annual household income.

The chart below provides guidelines for the poverty threshold and shows different income levels relative to household size and a measurement called the Federal Poverty Level (FPL). The income below only shows FPL levels from 138% to 400%, the range in which consumers are eligible to receive financial subsidies through Nevada Health Link.

Federal Poverty Level Chart for Nevada 2024*

*Effective 4/1/2025

If you do not qualify for financial assistance because your income is below the 138% FPL, you may be eligible for Medicaid.

Get Help Enrolling