What is an HRA?

A health reimbursement arrangement (HRA) is a tax-preferred, account based health benefit funded by employers to pay for a variety of health care expenses:

- The ACA generally prohibits HRAs and similar arrangements because they violate the annual limit and preventive services rules

- Obama Administration guidance allowed a narrow exception: HRAs that are “integrated” with traditional employer coverage

- Result: Employers could not provide pre-tax dollars to help employees buy individual market coverage

- The October 12, 2017 Executive Order called for easing rules on HRAs, short-term plans, and association health plan

- On October 29, 2018, HHS, DOL, and Treasury/IRS (the Departments) issued proposed regulations loosening rules on HRAs

- On June 13, 2019, the Departments finalized the proposed regulations with a few changes

- Final HRA regulations released in June 2019 include complex new rules that take effect in 2020, including rules on how HRAs affect APTC eligibility and rules that require certain individuals offered HRAs to purchase coverage outside the health insurance marketplace.

What is a Qualified Small Employer (QSE)HRA?

Small employers who don’t offer group health coverage to their employees can help employees pay for medical expenses through a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA). If your employer offers you a QSEHRA, you can use it to help pay your household’s healthcare cost (like your monthly premium).

What is a Individual Coverage (IC)HRA?

Health Reimbursement Accounts (HRAs) are employer-funded group health plans from which employees are reimbursed tax-free for qualified medical expenses up to a fixed dollar amount per year. Unused amounts may be rolled over to be used in subsequent years. The employer funds and owns the account. Health Reimbursement Accounts are sometimes called Health Reimbursement Arrangements.

Who is eligible, and how do I find out if I’m eligible for an HRA?

HRAs are offered through employers. To find out if you are offered an HRA contact your employer.

My employer is offering me an HRA, what should I do next?

If you need assistance in finding out if you should take the offered HRA, or if you qualify for tax credits, please seek enrollment assistance through a certified Agent, Broker, or Certified Enrollment Counselor. You can find a list of certified individuals through the Find Assistance Lookup Tool.

Resources

Health Reimbursement Arrangements (HRA) resources

Important Information to know:

After you have completed your application and selected a plan to enroll in you have the option to adjust your APTC based on your ICHRA or QSEHRA funds. Follow the steps below to adjust your APTC.

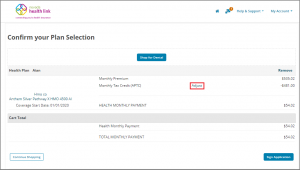

1. Complete your application, select a plan to enroll, and navigate you your cart.

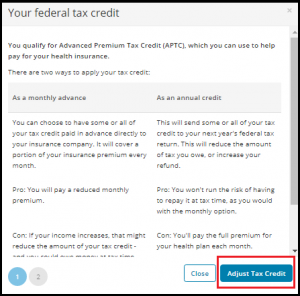

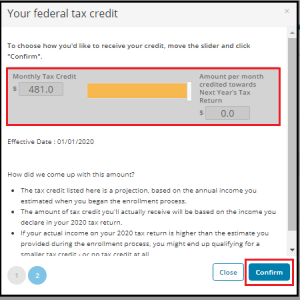

2. Confirm your APTC adjustment.

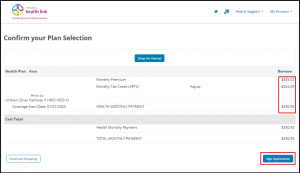

3. Review your changes and sign your application.

Training:

The Centers for Medicare and Medicaid (CMS) has put together a training to assist in the understanding of the Individual Coverage Health Reimbursement Arrangements. The CMS Training Guide provides a high level overview on ICHRAs and QSEHRAs.

Get Help Enrolling